In a fast-changing market scenario, a PIP plays an important role in defining the minimum measurable change for an asset. A trader should make sure to understand the importance of PIPs, as their implementation in trading can increase the sharpness of a trading strategy and decision-making skill. This article delves deep into PIPs, their appreciation in one type of trading over another, and illustrative examples to pound the concepts into your heads

What is a PIP?

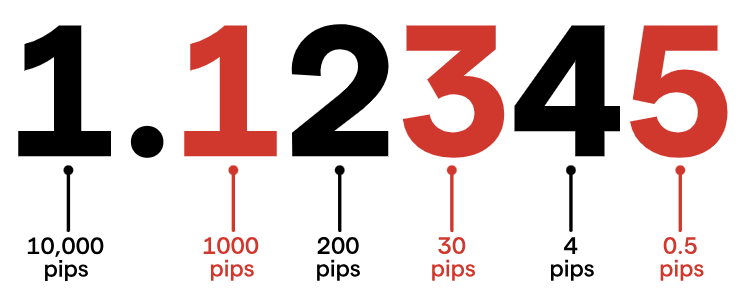

A PIP (Percentage in Point or Price Interest Point) is a unit of measurement that quantifies the smallest price movement in an asset.

Key Points:

- In Forex trading, a PIP typically equals 0.0001 for most currency pairs.

- In commodities, the value of a PIP depends on the asset being traded, often expressed as the smallest change in price (like 0.01 for gold).

- In cryptocurrency trading, a PIP can be as small as 0.01 or even smaller depending on the asset and market.

How PIPs Work in Different Markets

1. PIP in Forex Trading

Currently, PIP has made its debut in Forex trading. How it started is what you will understand best if you will get to understand what PIPs are and how to use them; then, calculating the most minimal possible price movement in a currency pair will be easy.

Common Forex PIP Rules:

- For most currency pairs (like EUR/USD, GBP/USD), 1 PIP equals 0.0001.

- For pairs with JPY (like USD/JPY), 1 PIP equals 0.01.

Example:

- If the EUR/USD price moves from 1.1000 to 1.1001, that’s a 1 PIP increase.

- For USD/JPY, a price change from 110.50 to 110.51 equals a 1 PIP change.

Forex PIP Calculation Formula:

Lot Sizes in Forex:

- Micro Lot = 1,000 units

- Mini Lot = 10,000 units

- Standard Lot = 100,000 units

Why PIPs Matter in Forex Trading?

- Risk Management: Helps set stop-loss and take-profit limits effectively.

- Profit and Loss Calculation: PIPs allow traders to determine potential gains or losses.

2. PIP in Commodity Trading

In commodity trading (like gold, oil, and silver), PIPs denote the smallest price movement a commodity can make. Since commodity markets operate differently from Forex, PIP values can vary based on the asset.

Common Commodity PIP Sizes:

- For gold (XAU/USD), 1 PIP equals 0.01.

- For crude oil (WTI), 1 PIP is often 0.01.

Example:

- If gold moves from 1900.00 to 1900.01, that is a 1 PIP change.

- In crude oil, a price shift from 60.00 to 60.01 equals a 1 PIP change.

Commodity PIP Calculation Formula:

Why PIPs Matter in Commodity Trading?

- Accurate Price Monitoring: Helps track minor price changes in highly liquid commodities.

- Risk Mitigation: Enables precise position sizing and risk management.

3. PIP in Cryptocurrency Trading

Cryptocurrency markets are highly volatile, with assets like Bitcoin, Ethereum, and altcoins experiencing large price swings. PIPs in crypto trading measure the smallest change in the price of a digital asset.

Common Crypto PIP Sizes:

- For Bitcoin (BTC/USD), 1 PIP equals 0.01.

- For Ethereum (ETH/USD), 1 PIP also equals 0.01 or sometimes even smaller.

Example:

- If BTC/USD moves from 40,000.00 to 40,000.01, that’s a 1 PIP change.

- If ETH/USD changes from 2,500.00 to 2,500.01, that is a 1 PIP change.

Crypto PIP Calculation Formula:

Why PIPs Matter in Crypto Trading?

- Volatility Management: Helps traders navigate large price swings.

- Strategic Entry and Exit Points: PIPs allow precise trade entries and exits.

The success of your trading strategy depends very much on your understanding of the PIPS. Here are a few reasons why PIPs are important:

Why PIP is Important Across Different Trading Types?

1. Accurate Calculation of Profits and Losses

PIPs provide a standard method by which profits and losses may be calculated across the various markets. If PIPs are not understood, a trader may find it very difficult to assess his trades.

Example:

A 50 PIP change in EUR/USD trading 1 standard lot means a $500 profit/loss.

A 30 PIP change in gold trading 100 units means a $300 profit/loss.

2. Effective Risk Management

PIPs give traders the ability to set their risk tolerance by setting stop-losses and take-profits. If a trader is not tracking PIPs, he could be risking more than he wanted to.

Example:

In Forex, having a 20 PIP stop-loss is sure to save his butt from some major losses during selling price punishment.

3. Position Sizing and Lot Calculation

Knowing PIP values helps in calculating the correct lot size to avoid overexposure.

Example:

For a micro lot, 1 PIP equals $0.10, allowing low-risk trading for beginners.

How to Calculate PIP Value in Different Markets?

Forex Calculation Example:

- EUR/USD moves from 1.2000 to 1.2005, that’s a 5 PIP change.

- For a standard lot (100,000 units), 1 PIP equals $10.

- 5 PIPs = $50 change.

Commodity Calculation Example:

- Gold (XAU/USD) moves from 1900.00 to 1900.50, that’s a 50 PIP change.

- For 1 lot, the PIP value can be $1 per PIP.

- 50 PIPs = $50 change.

Crypto Calculation Example:

- BTC/USD moves from 40,000.00 to 40,000.10, that’s a 10 PIP change.

- For 1 BTC, each PIP could be worth $1.

- 10 PIPs = $10 change.

Key Takeaways: Why You Should Master PIPs

The Functionality of Trading: Price movements can be accurately measured because of PIP; hence minimal inaccuracies occur.

Control of Risks: Through PIPs, effective stop-loss levels and take-profit levels can be achieved.

Optimizing Profits: Comprehension of PIPs gives a trader an opportunity for fine-tuning strategies for maximizing gains.

Better Developing Strategy: PIPs also build the adequate base for back testing and system improvement for trading.

Final Thoughts:

PIPs are a critical concept that every trader should master, regardless of the market they trade in. Whether you’re trading Forex, commodities, or cryptocurrencies, understanding PIPs provides a clear advantage in managing risk, calculating profits and losses, and fine-tuning your trading strategy. By consistently incorporating PIPs into your trading routine, you will gain better control over your investments and enhance your decision-making skills.