What Is A Signal Provider?

A signal provider can be a professional trader, trading algorithm, or actual trading system producing trade recommendations that traders can act on, hence known as trading signals. Such signals will leave traders with an understanding of the right moment to enter, modify, or exit a trade across various financial markets such as forex, crypto, stocks, and commodities. These signal providers can be particularly necessary for novice traders who want to make use of professionals’ expertise or for busy traders who could not find the time to conduct thorough market analysis. By following these signals, traders may be able to boost the success rates of their trades without requiring spectacular technical knowledge.

How Signal Providers Analyze the Market

Various analytical methods can be applied by signal providers to yield trustworthy signals; some of these include:

Technical Analysis: This method includes price chart examination, price pattern identification, and technical indicator applications like Moving Averages, RSI, MACD, and Fibonacci retracements to ascertain the likely price behavior.

Fundamental Analysis: Signal providers assess the economic indicators, geopolitical issues, interest rate changes, etc. market news that affects pricing of assets.

Sentiment Analysis: Some providers monitor market sentiment based on volume, trader behavior, and psychological profiles to predict price moves.

Algorithmic and AI-Powered Analysis: Advanced providers wield artificial intelligence and machine-learning applications that sift through vast amounts of data to recognize trading opportunities stemming from historical patterns and trends.

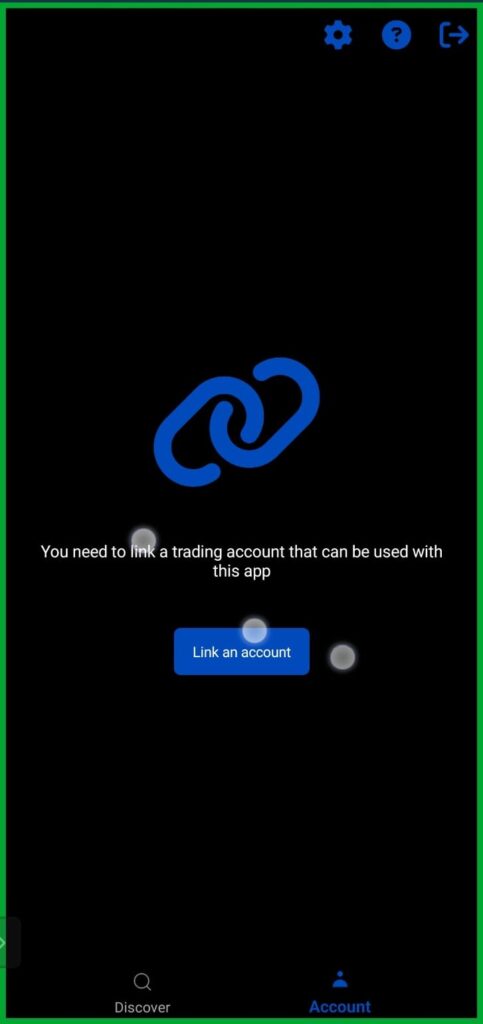

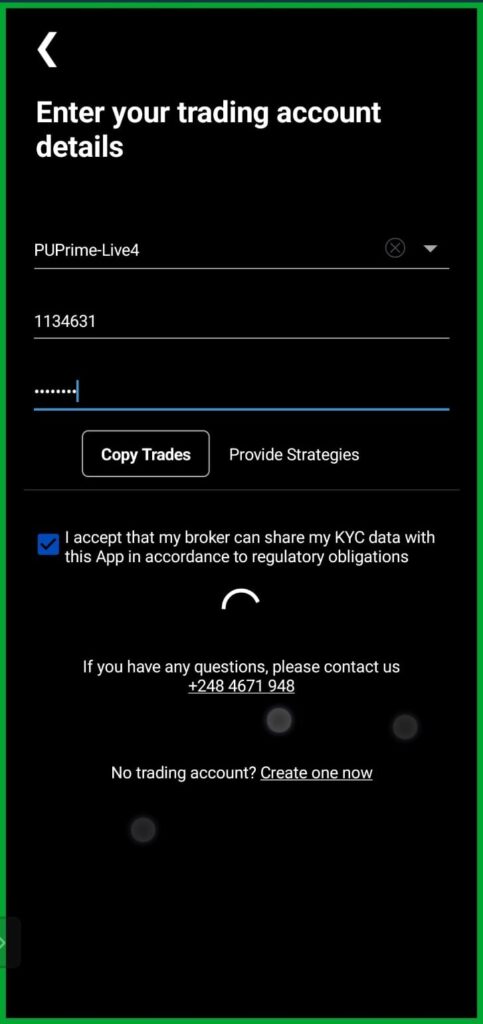

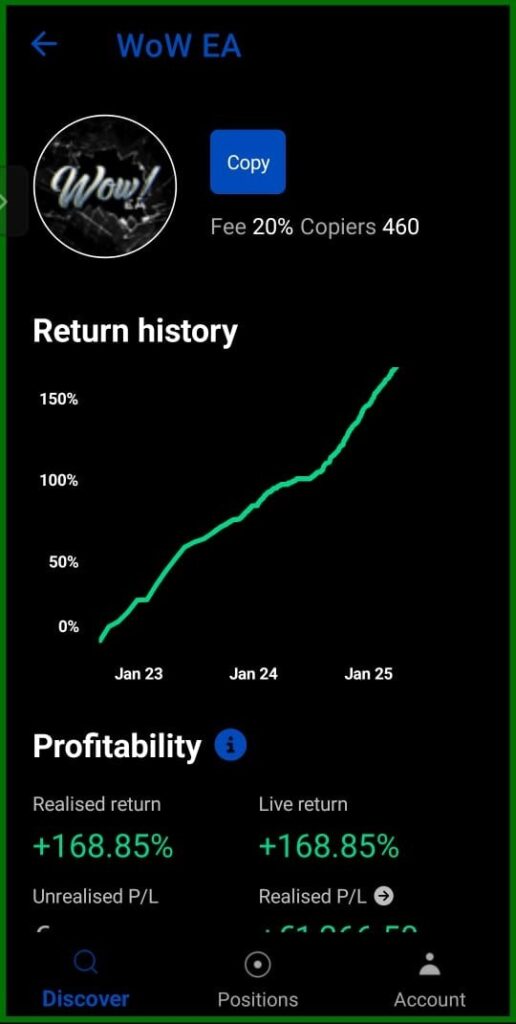

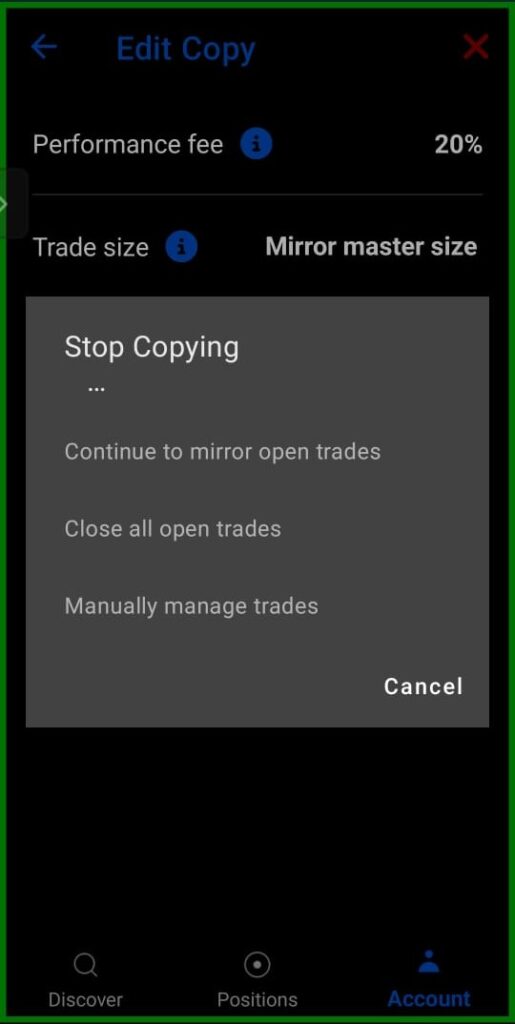

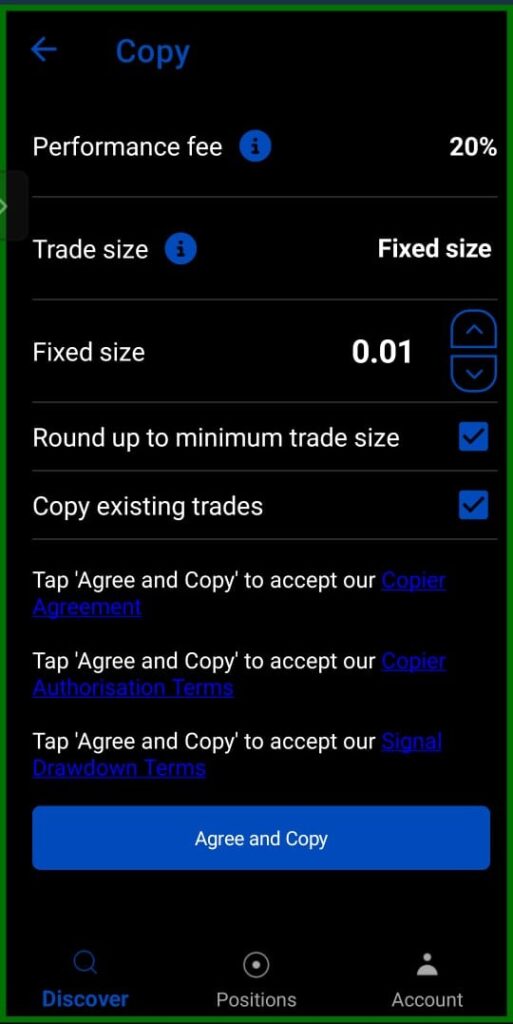

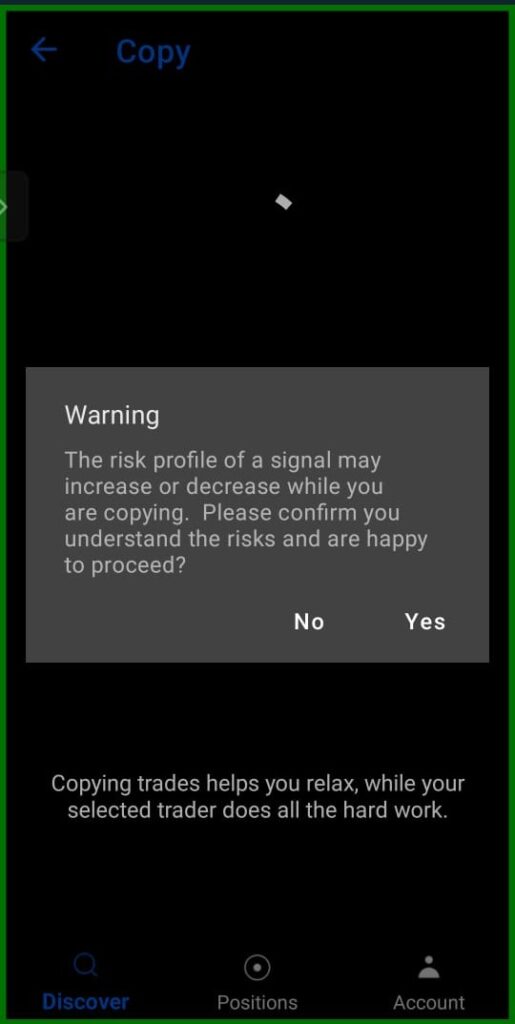

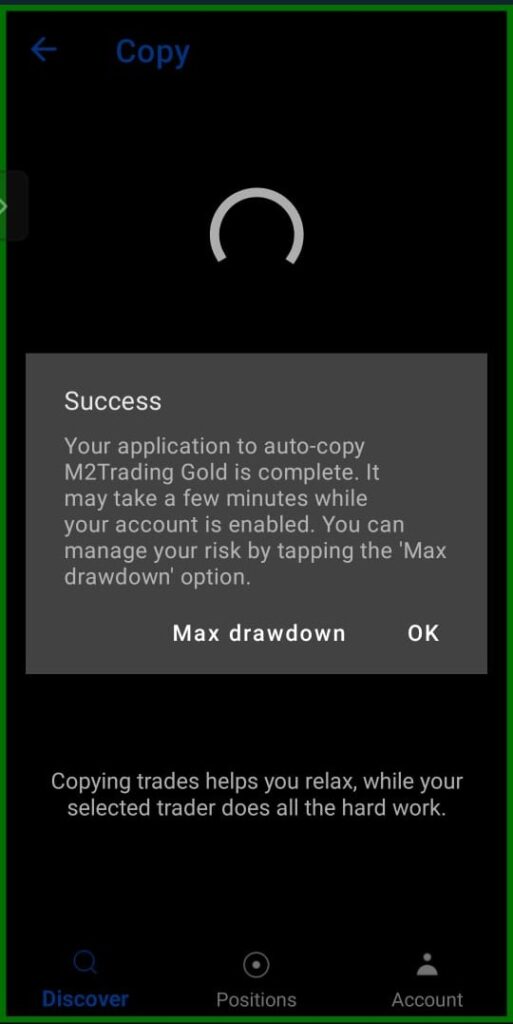

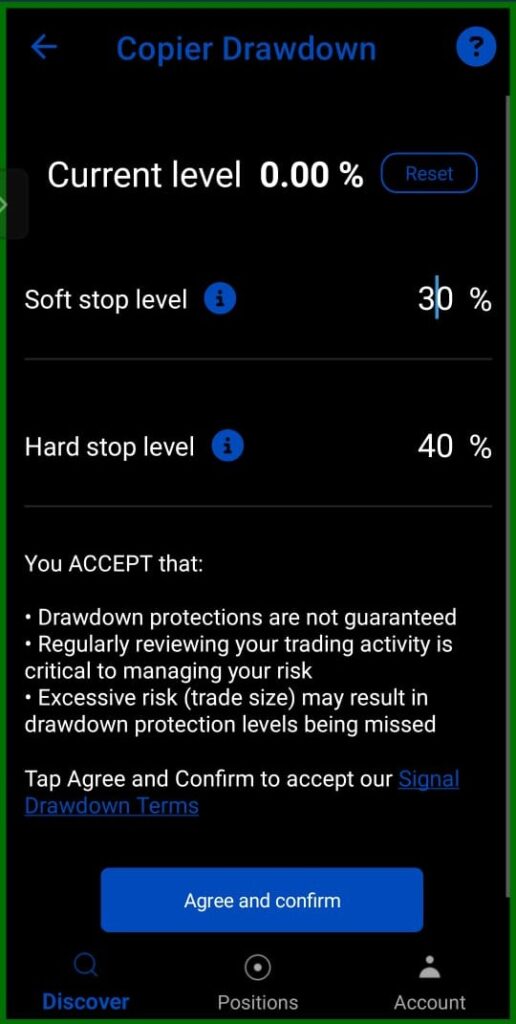

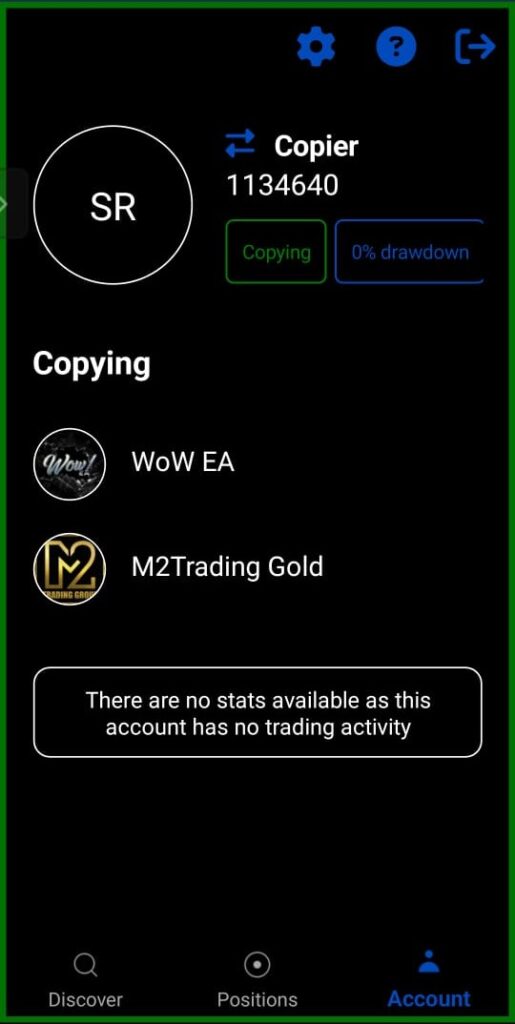

These are the steps to copy the signals as a copier

Key Features of a Signal Provider

Features to be assessed when selecting a signal provider:

Transparency: Truly reliable providers are completely transparent about their historical performance, win rate, and drawdown.

Consistency: Find a provider that shows a long track record of steady profits.

Risk Management Strategy: Top providers make sure that there is proper risk management in place regarding stop-loss and take-profit levels.

Ease of Integration: Many providers offer a great deal of integration with platforms such as MetaTrader 4/5, eToro, ZuluTrade, and NAGA, so users can automate copying of signals easily.

Benefits of Using Signal Providers

Signal providers have multiple benefits empowering traders to make informed decisions.

Time-Saving: Traders can now attend to other matters while automatic trading executes their trades. This saves them from monitoring manually.

Learning Experience: Beginners may learn from professional traders concerning trading strategies to boost their own.

Enhanced Profitability: The endorsement of trading by experienced traders or algorithm-based strategies AI applications increases the chances of successfully entering a trade.

Reduced Emotional Influence: By supporting trade-making decision systems, signal providers largely minimize the emotional bias involved in trading, thus letting trading be more systematic.

Trading Strategy Diversification: Traders can diversify their portfolios by following many signal providers with varying trading strategies.

The Different Categories of Signal Providers

Signal providers are categorized in several ways depending upon the manner in which they function:

Manual Signal Providers: These human traders who have hands-on market experience run analyses and generate signals manually. Their signal-generation is usually based on technical and fundamental analysis.

Automated Algorithmic Providers: These signal-producing entities are powered by AI and pre-programmed trading algorithms that lessen human error by taking direct input from market conditions.

Copy Trading Platforms: Platforms like eToro, ZuluTrade, and NAGA allow followers to automatically copy trades of those successful signal providers.

Subscription-Based Signal Provider: These providers, for a subscription fee, offer trading signals to clients, providing them with access to trade recommendations, analysis, and an insight.

Risks Associated with Signal Providers

Signal providers, although advantageous, bring with them some associated risk factors:

Over-Reliance on Signals: Complete dependence on the signal provider without market knowledge may, in fact, lead to losses if the chosen provider’s strategy is not performing well.

Market Volatility: Well-timed signals may still render poor performance due to highly volatile market conditions.

Untrustworthy Providers: Some signal providers may have poor transparency, and performance records do not inspire trust; hence the chances of incurring losses grow.

High Drawdowns: Aggressive trading strategies of signal providers can cause high drawdowns that seriously affect account balance.

How to Select The Best Signal Provider

If you are to select a signal provider to be trusted, please consider the following:

Track Record & Performance: Go and analyze historical performances and make sure the provider has a consistent profit record with low or minimal drawdowns.

Risk Management: Find out if the provider uses elements like stop-loss and take-profit correctly.

Communication & Update: Being a renowned provider means that such a provider should communicate regularly and offer updates on prevailing market conditions.

User Reviews & Ratings: This is a good way to gauge a provider’s reliability and performance in the signal provider industry.

Charges & Subscription Costs: You will find out how much they charge, and you need to see if the price in any way gives value to the service.

Tips for Maximizing Returns with Signal Providers

To enhance trading outcomes with signal providers, follow these tips:

Signal Provider Diversification: Don’t put all your eggs in one basket. Diversify against different strategies to better minimize risk.

Monitoring Performance: Keep checking the performance of the signal provider and change accordingly.

Realistic Expectation-Setting: Understand that no signal provider can guarantee 100 percent success; sometimes, losses may happen.

Risk Settings-Wise: Setting leverage, risk, and drawdown limits can keep capital safe.

Conclusion

The signal providers link the experienced trader to the novice, providing useful information and automation of trading decisions. Through systematically adopting a fixed, reputable signal provider, traders can therefore improve their trading outcomes, learn from the experts, and mitigate their risks. Still, in order to maximize returns while staying hedged against market fluctuations, one must periodically reassess the performance and risk parameters of signal providers on one hand and diversify by adopting multiple signal sources on the other hand.

Looking to Open a PU Prime Account?

✅ Get started today with Chanakya Investments!

📈 Open PU Prime Account:

https://in.puprime.com/forex-trading-account/?affid=60590

📈 Verify Your Account:

Make sure to complete all necessary verification steps to ensure your account is active and compliant with regulations. You need Aadhar Card & Bank Statement.

📊 Download MT4 Android App

https://drive.google.com/file/d/1-_tRSHoX6BSUmCDkJCOhOSUT3E1na_pq/view?usp=sharing

📊 Download MT5 Android App

https://drive.google.com/file/d/1YTzaNHhNgWmhKdx5XcgmQLR7bHyJqxfq/view?usp=sharing