The contemporary financial landscape is in constant change. Within this context, Copy Trading, as it is popularly known, is a game changer for individuals interested in profiting from the expertise of professional traders without active portfolio management. Thanks to copy trading, it now also opens its doors to trading for beginners and investors who often find themselves against time. Equipped with only a mouse and minimal initial capital, anyone can now invest like a pro. This article discusses the other considerations for copy trading, including its workings, advantages, disadvantages, and tips for success.

What is Copy Trading?

Copy trading may be defined as an automating trading system whereby investors copy the trade of a professional trader with years of experience and success. The trade of buying or selling an asset made by somebody you have chosen to follow will trigger an automatic buy or sell entry in your own trading account at that same moment in time. In this way, you benefit from all of the potential gains or losses alongside the professional, without putting any thought into the trading decision whatsoever.

Thus, copy trading tries to resolve the problem that retail investors meet in getting nearer to professional traders. It works by linking the account of the copier with that of a trader who has been selected purposely. All actions of the professional trader are then replicated in the copier’s account in proportion to the amount of capital allocated.

If, for instance, the trader you copied would put 5% of his portfolio into a certain stock, you would also allocate the same proportion to your account. This, therefore, renders copy trading a passive but really smart investment strategy.

How Copy Trading Platforms Work

Copy trading is an activity that requires an investor to sign up with copy trading platforms or brokers. Below is a quick summation of how it works:

Step 1: Register on a Copy Trading Site

Platforms like eToro, ZuluTrade, NAGA, and MyFXBook provide good interfaces to browse, analyze and select traders to copy. These platforms aggregate various traders with diverse strategies and performance tracking. It helps copiers know what to do before starting.

Step 2: Analyze Trader Profiles

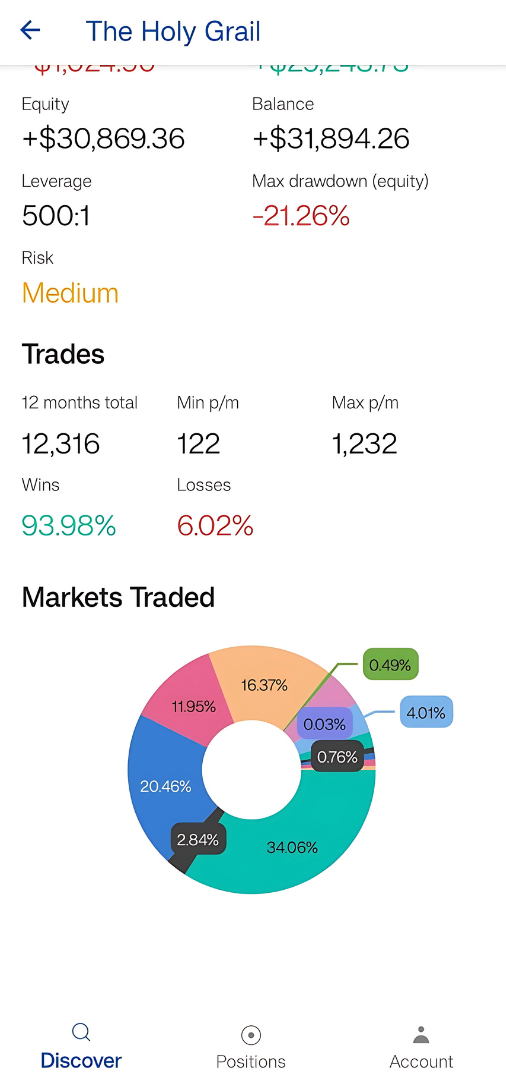

All traders on a copy trading platform have an extended profile by virtue of which detailed data is found about their trade performance using different assets, win rates on trades, drawdown levels, risk scores, historical returns, etc. This helps copiers filter and compare traders on a basis of such criteria, such as profitability, number of copiers, trading style, and so on.

Step 3: Capital Allocation

Whenever a trader is selected by the copier, the copier allocates towards copying that trader part of his total capital. The amount allocated can be altered over time in accordance with the copier’s preferences and risk appetite.

Step 4: Operation of Trading Automatically

Any time that the copied trader opens, changes, or closes a position, the same action performs automatically within the copier’s account. The amount of capital the copier allocated determines how the trades are proportioned to the copier and ensures that the returns (and losses) are in sync with the chosen trader’s performance.

Step 5: Monitoring and Changes

Copy trading is mostly automated. It is thus crucial for copiers to keep a close tab on how their selected trader(s) do from time to time. Investors have the option of halting copying, reallocating capital, or changing a certain trader if their performance does not meet the expected outcome.

Check Out These Successful Copy Traders!

Check Copiers, Return History, Profitability, Leverage, and Risk to choose the right trader

Types of Copy Trading Models

Modified forms of copy trading are available to accommodate investors’ different needs in some cases. This flexibility is helpful when one invests in the model that matches one’s goals and risk exposures.

1. Manual Copy Trading

For manual copy trading, investors carry out the analyses and selections of the trades they want to copy. This may be considered the main drawback of having less control over what trades will be copied. But on the flip side, it requires some level of understanding of the markets and perusing every opportunity for trading.

2. Automated Copy Trading

This is indeed the most popular and easiest model, wherein all trading decision making and thus their executions are immediately mirrored in the account of the copier. The moment a trader is chosen and the capital allocation made, the system takes control of everything in real time.

3. Social Trading

As an extension of copy trading, social trading brings community features to the service: it allows users to copy trades but can also interact, discuss strategies, and share insights into market trends with other traders. In combining the benefits of copy trading with those of collaborative learning, social trading yields an improved form of copying.

Key Benefits of Copy Trading

1. Perfect for beginners: Beginners can skip most of the rocky process of learning by depending on the skill of professional traders. Copy trading reduces the engagement of much technical analysis or even deep market knowledge.

2. Save Time and Energy-it is hassle-free for pre-occupies individuals without time to study markets or plan trading strategies.

3. Obtaining Different Strategies-It allows all investors to experiment with different trading styles like day trading, swing trading, or longer investment by copying more than one trader using another approach.

4. Spreading the Risk-Investors can follow different traders or approaches and thus have more risky portfolios to reduce the overall risk associated with depending on a particular strategy.

5. Transparency with Real-Time Insights: Most copy trading platforms offer a complete transparency perspective with a clear record of historical data performance, risk levels, and trading patterns of the professional traders, which provides the necessary foundations to make informed decisions.

6. Learning It also becomes an application through which beginners can learn the reasons for specific trades by watching expert proceedings about market trends.

Challenges and Risks in Copy Trading

If copy trading has a lot of benefits, it still poses some threats and dangers. Knowledge of these hurdles would better place investors in decision-making.

1. Guarantees on Zero Profits

Even the best-skilled trader suffers losses in trade, which mere copying will not guarantee the same behavior. The market tends to fluctuate and go wrong due to unknown factors.

2. Risk of Over-Reliance

When traders rely on one single trader, they could suffer much higher risks if that trader’s strategy fails or has a bad streak of losing.

3. Platform Dependency

The robustness of the copy trading platform is of prime importance. Technical glitches, delays in execution, or system failures may further restrict traders from replicating trades.

4. Fees and Commission Costs

These platforms mostly charge commissions, performance fees, or spread charges, which will eat into the copier’s returns significantly.

5. Limited Control Over Trades

There are limited capabilities for copiers in automated copy trading regarding each trade, which sometimes causes them to lose the chance for manual adjustments.

Best Practices for Successful Copy Trading

To add in maximizing one’s copy trading ability, it is important to adopt a certain strategic approach. Following are some best practices with respect to copy trading:

1. Diversify Your Portfolio

Copy not just one but several different traders using various strategies and asset classes. Allow your diversification for spreading risks and enhancement of overall stability.

2. Analyze Trader Performance

Consider traders, not just among other things, but on the basis of long-term performance, risk appetite, and consistent performance rather than short-term gains. Scour for traders with no drawdown and evidenced sustainable growth.

3. Start Small and Scale Gradually

Squeeze into a small allocation to experiment with it first, then scale upwards when confidence in that platform and the chosen trader has been achieved.

4. Monitor and Review Regularly

Automated copy trading goes, but it still calls for a periodic performance review and a chance to adjust if necessary. What happens if the results go haywire?

5. Understand the Risks Involved

Learn about potential risks and place stop-loss limits to protect capital from excessive losses.

Is Copy Trading Right for You?

Copy trading seems a good alternative for many who wish to step into the trading world but have no knowledge or time to analyze the market. It is best suited for:

- The newcomers who want to learn about trading by observing the professionals.

- The passive investors want to maintain a hands-off approach to trading.

- The busy professionals wish to diversify their sources of income without allocating time to trading.

On the other hand, copy trading may not appeal to those desiring complete control over their trading decisions or who dislike high-risk scenarios.

Conclusion

Copy trading is a great way for both novice and experienced investors to rely on the knowledge of seasoned traders while saving a lot of time. While this is a good passive income-generating opportunity, one must understand the risks involved and diversify the investment strategy as a measure against these potential losses. Devising a strong selection of traders, combined with proper risk management, solid performance monitoring, could see copy trading morph into a significant contributor to the building of a strong, diversified investment portfolio.

Maximize your profits with copy trading! Follow @chanakyainvestments for step-by-step guidance.

Looking to Open a PU Prime Account?

✅ Get started today with Chanakya Investments!

📈 Open PU Prime Account:

https://in.puprime.com/forex-trading-account/?affid=60590

📈 Verify Your Account:

Make sure to complete all necessary verification steps to ensure your account is active and compliant with regulations. You need Aadhar Card & Bank Statement.

📊 Download MT4 Android App

https://drive.google.com/file/d/1-_tRSHoX6BSUmCDkJCOhOSUT3E1na_pq/view?usp=sharing

📊 Download MT5 Android App

https://drive.google.com/file/d/1YTzaNHhNgWmhKdx5XcgmQLR7bHyJqxfq/view?usp=sharing